Innovation is the driving force behind progress, and the realm of financial models is no different. As businesses navigate the continuously evolving finance landscape, embracing new approaches that fuel growth, boost profitability, and adapt to the ever-changing market dynamics is crucial.

This blog post will explore five key steps to innovate financial models, empowering organizations to make informed decisions, optimize resource allocation, and unlock new opportunities. From embracing technology-driven solutions to fostering a culture of continuous improvement, these steps will provide a roadmap for businesses seeking to revolutionize their financial strategies.

In today's rapidly changing financial landscape, adaptability is key

Encourage your finance team to embrace change and foster a culture of innovation and continuous improvement. By unlocking adaptability, your organization can quickly adapt to evolving market dynamics and drive growth by staying flexible and open to new ideas.

Prioritizing initiatives that drive the most change and significantly impact your organization's financial performance is important. Identify key performance indicators (KPIs) that align with your strategic goals and use them to measure the impact of your financial strategies. By focusing on initiatives that deliver tangible results, you can optimize resource allocation and drive meaningful change.

In today's digital age, automation, and digitization are crucial for financial innovation. Embracing technology-driven solutions such as digitization and automation allows you to create real-time reporting and faster cycle times while streamlining repetitive tasks. This improves efficiency and lets your finance team focus on high-value strategic activities.

Unifying data and driving standardization across global subsidiaries is essential to innovate financial models effectively. Implement secure cloud-managed platforms that eliminate data silos and ensure consistent and accurate financial information. Centralizing data and standardizing processes can enhance visibility, improve decision-making, and drive efficiency across your organization.

Implementing advanced data analytics and artificial intelligence (AI) technologies can provide valuable insights into your financial performance, identify trends, and make more informed decisions. By leveraging data analytics and AI, your organization can become more agile and responsive to market changes, ultimately driving growth and profitability.

Embrace innovation, leverage technology, and prioritize impact to stay ahead in the ever-evolving finance landscape

By following these five steps, your organization can revolutionize its financial strategies and pave the way for a brighter and more prosperous future.

- Unlock adaptability

In today's rapidly changing financial landscape, adaptability is key. Encourage your finance team to embrace change and foster a culture of innovation and continuous improvement. Your organization can quickly adapt to evolving market dynamics and drive growth by staying flexible and open to new ideas. - Focus on impact

Prioritizing initiatives that drive the most change and significantly impact your organization's financial performance is important. Identify key performance indicators (KPIs) that align with your strategic goals and use them to measure the impact of your financial strategies. By focusing on initiatives that deliver tangible results, you can optimize resource allocation and drive meaningful change. - Embrace digitization and speed

In today's digital age, automation, and digitization are crucial for financial innovation. Automating processes allows you to create real-time reporting and faster cycle times while streamlining repetitive tasks. Embracing technology-driven solutions improves efficiency and enables your finance team to focus on high-value strategic activities. - Drive governance and standardization

Unifying data and driving standardization across global subsidiaries is essential to innovate financial models effectively. Implement secure cloud-managed platforms that eliminate data silos and ensure consistent and accurate financial information. Centralizing data and standardizing processes can enhance visibility, improve decision-making, and drive efficiency across your organization. - Get insight

Implement advanced data analytics and artificial intelligence (AI) technologies to drive finance-first innovation. By leveraging data analytics and AI, you can gain valuable insights into your financial performance, identify trends, and make more informed decisions. This enables your organization to be more agile and responsive to market changes, ultimately driving growth and profitability.

Optimize Financial & Operating Models:

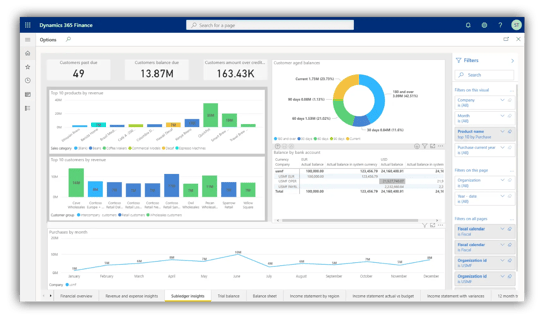

Dynamics 365 Service-Centric ERPs 👍

Microsoft Dynamics 365 ERP (Enterprise Resource Planning) is a comprehensive business management solution offered by Microsoft. It combines various modules and functionalities to help organizations streamline and integrate their core business operations, including finance, supply chain, manufacturing, sales, marketing, human resources, and customer service.

Benefits of Microsoft Dynamics 365 ERP ⬇️

- Integration: Dynamics 365 ERP integrates seamlessly with other Microsoft products like Office 365, Power BI, and Azure, allowing for a unified experience and data flow.

- Scalability: The solution is designed to accommodate the needs of businesses of various sizes, from small enterprises to large corporations.

- Flexibility: Dynamics 365 ERP can be customized and extended using the Power Platform, enabling organizations to tailor the system to their specific requirements.

- Cloud-based: As a cloud-based solution, Dynamics 365 ERP offers accessibility, automatic updates, and scalability without requiring extensive on-premises infrastructure.

- Data-driven insights: The built-in analytics and reporting capabilities help organizations gain actionable insights from their data to drive better decision-making.

Contact us for a Microsoft Dynamics 365 Assessment →

Our comprehensive assessment dives into the capabilities of Microsoft Dynamics 365, empowering your organization to streamline operations, enhance efficiency, and identify pain points within your current systems. Led by our team of expert Dynamics 365 professionals, this assessment delivers invaluable insights and personalized recommendations for optimizing your business processes. Don't miss out on unlocking the full potential of Dynamics 365 in just one week - sign up today!